i̇ş & ekonomi

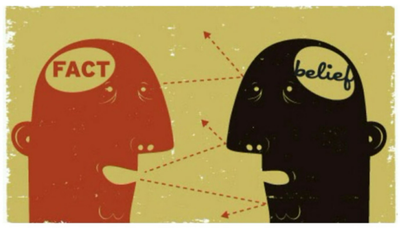

The common denominator fed by the concepts of "New Year" and "Economy" is "expectation management". Regardless of how bad the previous year was, more beautiful and better ones are always desired for the upcoming year; The level of belief that much better decisions and outputs will be produced than the previous one is "fully charged". If we did not have a lover in the past, the new one will be certain.

Read MoreIt is very helpful if you know a little bit of whole genome sequence history. The global human genome was started by globalist Clinton Administration in the 90s. The whole purpose is to better understand all human and non-human species on their genome structure so we could develop better medicines. So, less populated developed countries led by US to send billions of dollars to some most populated countries. Thus ILNM started to have the best NG and started to make tons of money on whole genome assembly projects.

Read MoreStrategic management, which has become a concept that is known today, is, in fact, a very new management practices and strategic management of the development process can be monitored from a recent date.

Read MoreTo explain briefly the concepts of finance and financing mixed together; Finance is about need. It means money, funds or capital that people or institutions can benefit from.

Read MoreThere are four different methods I use when valuing a business/company: 1. Discounted cash flow methodology 2. Relative valuation 3. Liquidation value 4. Outright sale Each valuation method has its own pros and cons.

Read MoreWhen it comes to making investment decisions, herding is a key factor. It's a behavioral pattern that affects a vast range of industries. During the last century, the American Economic Association was made up mostly of college professors of economics and the social sciences. But today, the membership has expanded to over 20,000 members. The problem with this pattern is that it can make investing a risky proposition.

Read MoreTraditional economics teaches that any asset can be valued solely on fundamental metrics: cash flows, earnings, capital structure, and sales growth are all that matter. But in reality, we can see from today’s markets that this alone is not true. Fundamental analysis does not have a monopoly on valuations, and it constantly enters into a paradoxical state with its stories of expectations. When doing analysis, acting solely on fundamental analysis, without taking into account the principles of “behavioral economics,” may not protect you even in the long run.

Read More