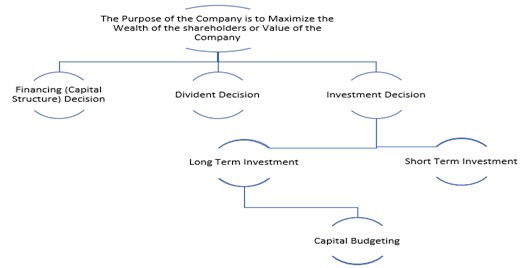

There are basically three important financial decision situations in firms. These decisions, which can be called as functions of finance, are investment decisions, capital structure (financing) decisions and divident decisions. In summary, the basic decision elements of the enterprises are the decisions to answer the questions from which sources should be obtained, for which purpose, what activities should be used and how the profits should be evaluated. To explain briefly the concepts of finance and financing mixed together; Finance is about need. It means money, funds or capital that people or institutions can benefit from. Financing is about ensuring this. Financing is the provision of money, funds or capital that the enterprise needs.

Financial management, on the other hand, is the most efficient use and management of the capital required by the enterprise by providing the fund in the most economic way. Corporate finance is a branch of finance that deals with general funding resources and capital management for corporations. The increase in capital investments and the distribution of financial resources cannot be avoided in any way. The main objective of this sector is to increase shareholder values and to increase the value of the company in return. This would require the managers to find a balance between the funds and profit share payments that ensure the long-term profitability and sustainability of firms.

Corporate finance works in the same way as other banking fields, but there are still minor differences compared to these fields. Managers in this area have two roles, usually the first is to find people or institutions that can volunteer for the lending process with a minimum interest rate and the second is to provide capital to these people and institutions by making sure that these funds will be used most effectively in other people, institutions or projects. These are the basic rules and functions of corporate finance. In short, corporate finance is a branch of finance that brings investors and entrepreneurs together. The resources that an enterprise can provide finance or capital are very diverse. For this reason, when choosing between alternative sources in the capital or financing decisions of the enterprise, the potential risk of the alternative source to be used and the characteristics of the financing instrument to be used in the acquisition of the resource have to be taken into consideration separately and together. In addition, financing decisions should not be considered as one-off decisions.

Financing decisions are decisions that are made at one time but which will continuously affect the business strategies. Because the financial decisions taken today directly affect the future decisions of the enterprise and may make the enterprise difficult in the future. Therefore, the impact of today's financing decisions on business activities should be analyzed continuously. Although there are a large number of studies on this subject in the literature, how to make financial decisions in firms and the factors that affect these decisions are not completely clear. When we look at the present, it is seen that there are different views on traditional finance based on this issue. Traditional finance models are the models that are produced by simplifying the real world. Taking these models as they are and applying them to real world events is an element that can lead to wrong decisions and cause undesirable results.

There are basically three important financial decision situations in firms. These decisions, which can be called as functions of finance, are investment decisions, capital structure (financing) decisions and divident decisions. In summary, the main decision elements of the enterprises are the decisions to answer the questions from which sources should be obtained, for which purpose, what activities should be used and how the profits should be evaluated.

Firms can use various sources to meet their working capital needs and finance their investments. While all activities can be financed by equity or borrowing, firms generally use both sources at varying rates. Financing through equity; It refers to companies applying for the resources they create within their own structure (undistributed profits, the addition of internal resources to capital) or outsourcing (providing funds through issuance of stocks). When borrowing is used, short-term, medium-term and long-term loans used by companies from banks come to mind. However, a simple distinction in the form of debt and equity in financing sources may cause us to overlook the wide range of financing instruments used by companies today. For example, bonds, financing bills, securities interchangeable with stocks (warrants, stocks interchangeable bonds), derivative instruments (options, futures, forward contracts and swaps) are some of them. According to Damodaran (2015) these core corporate financial principles can be stated as follows:

• Investment Principle: Invest in assets and projects that generate returns greater than the minimum acceptable level of obstacles. Obstacles must be higher for risky projects and must reflect the mix of financing used - owner's funds (equity) or loan money (debt). Project returns must be measured based on the cash flow generated and the timing of this cash flow; they must also consider the positive and negative side effects of these projects.

• Funding Principle: Choose a mix of financing (debt and equity) that maximizes the value of the investment made and matches the financing to the nature of the asset being financed.

•Dividend Principle: If there is not enough investment that results in an obstacle level, return the cash to the business owner. In the case of a public company, the form of return - dividends or share buybacks - will depend on what the shareholders like. When making investment, funding, and dividend decisions, corporate finance does not have a single goal, which is assumed to maximize business value for its owner. These first principles provide the basis from which we will extract the various models and theories that make up modern corporate finance, but they are also common sense principles.

The result of an investor's desire to have a diversified portfolio and limited executive wealth is the separation of ownership and control that we see in a typical modern company. Shareholders own most companies, but have little control. Executives have control over the company but have relatively low ownership. If everything works well, shareholders benefit from executive skills and executives benefit from shareholder capital. However, it works well only if the executive has attributes and skills that benefit shareholders. In this way, the management of the company is considered an agent for its owners and therefore manages the activity on behalf of the shareholders (the principal), that is to say. Companies owned by shareholders but managed by management.

Agency theory is one of the most widely used theories in management science. It deals with conflicting interests between pricipals and agents. Jensen and Meckling's (1976) model of agency costs and ownership structures play a central role in the corporate governance literature. Their theory, however, shows well the underlying conflict of interest between manager and owner. The main insight of Jensen and Meckling (1976) is to model the relationship between owners and the manager is similar to the one between the principal and the agent. The contract owner is the manager for carrying out the control tasks of the company, and because both are trying to maximize their own utility and are interested in themselves conflicts of interest arise. Because managers have effective control over the company, they have incentives and the ability to consume benefits at the expense of the owner. They determine the costs caused by differences in interests between owners and managers as agency costs consisting of 1) monitoring expenses by the principal, 2) bonding expenses by agents and 3) residual losses, which will be the focus of our attention. The general-agent principal model focuses on bilateral arrangements in which an actor (conventionally "he") hires an agent (conventionally "he") to carry out several activities on his behalf (Boss,1973). In its application that is more specific to the company, agency theory postulates, inter alia, that to motivate managers (agents) to take action and choose the level of effort in the best interests of shareholders (principals), board of directors, acting on behalf of the holders stocks, must design incentive contracts that make agent compensation dependent on measurable performance outcomes.

The theory suggests that principals have two options for reducing agency problems (Eisenhardt, 1989), both of which can curb opportunistic behavior of agents. The first is creating a governance structure that allows monitoring and evaluating the actual behavior of agents (Chrisman et al., 2007). This structure includes, for example, reporting procedures, additional management, or the board of directors (Donaldson&Davis, 1991). The second is to create a governance structure in which contracts are based on the actual results of agent behavior (Eisenhardt, 1989). According to Jensen et al (1976) in the language of modern economic theory, agency costs arise when one or more people, the principal, engage the person or other people, agent, to carry out some activities on their behalf, such that the decision-making authority is substantially delegated by the principal to the agent. If the two people are maximizing utility, then there is a good reason to believe that the agent will not always act in the interests of the principal, which results in agency costs - which are usually borne by the principal. A specific example of a principal-agent relationship, according to modern economists, is the contractual arrangement between shareholders and managers of public companies.

According to another opinion, if the reasonable expectations of shareholders are met in terms of receiving regular dividends and have the ability to release the value of their shares at any time by selling them on the stock market, then the activities of looking for managers must be considered inevitable and investment costs in the company's shares can be accepted. This does not seem to be the desired conclusion (Pepper, 2019). Unlike the standard agency framework, which focuses on monitoring costs and aligning incentives, behavioral agency theory(Pepper&Gore, 2015) places agency performance and work motivation at the center of the agency model, arguing that the interests of shareholders and their agents are likely to be aligned if executives are motivated to do their best from their abilities, given the available opportunities. This builds on four modifications to agency standard theory that have been identified as key factors influencing behavior by behavioral economists and economic psychologists. This modification is related to:

• Risk and uncertainty;

• Temporary deduction;

• Justice and unwillingness of inequality;

• Intrinsic and extrinsic motivation.

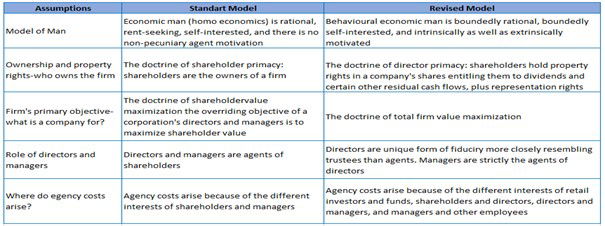

Fig: Assumptions That Underpin the Standard and Revised Agency Model

However, even if most of the assumptions are relaxed, a conflict of interest between the owner and the manager is relevant as long as the owner cannot observe the manager's actions or their consequences fully. The doctrine of maximizing shareholder value (short-term), advocated by Milton Friedman and others, is misunderstood - it does not serve the best long-term interests of the company, shareholders, employees, or the public. This must be replaced by a new doctrine of maximizing total long-term corporate value. Directors, investors, employees, and other important stakeholders must be encouraged to unite in this new doctrine. Maximizing total long-term corporate value must be the main goal of all public companies. The Jensen & Meckling model shows that agency problems exist, when there are possibilities and incentives for management to pursue their own interests at the expense of external stakeholders (both shareholders and bondholders).