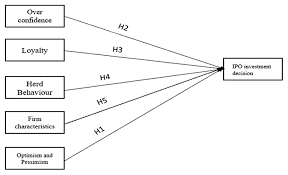

I have long known that the herd psychology effect is a real factor in investing decisions. This phenomenon occurs when investors lack information-processing abilities, are not confident in their beliefs, or follow the majority. As a result, they make irrational investment choices. This phenomenon has been observed in both the stock market and the real estate market and is one of the leading causes of financial crises worldwide. Moreover, it can lead to poor decisions.

Although herding behavior is an especially important concept in finance, it is often misunderstood. It is a powerful force that helps investors make rational decisions based on objective criteria. Investing in a stock based on herd psychology can benefit you in several ways. Using your herd instinct to sell when the crowd is panicking can save you from losing a lot of money. In fact, the herd psychology effect is so powerful that it has been used to explain a variety of topics, from fads to mass delusions.

When it comes to making investment decisions, herding is a key factor. It's a behavioral pattern that affects a vast range of industries. During the last century, the American Economic Association was made up mostly of college professors of economics and the social sciences. But today, the membership has expanded to over 20,000 members. The problem with this pattern is that it can make investing a risky proposition.

Herding may also increase the likelihood of investing in a particular security. Investing in stocks based on herd psychology is a dangerous practice that can lead to big losses. The fact that people are following the herd can encourage them to invest more than they otherwise would have. In some cases, this behavior results in the creation of unstable asset bubbles. While shedding is a natural phenomenon, it is a highly risky approach to investing.

The herd psychology effect is a major cause of volatility in the stock market. In a stable environment, investors follow the herd rather than follow their own judgment. In addition, herding is a natural tendency in some markets. In a volatile environment, investors often tend to make irrational decisions. The herd's behavior is a sign of low information and uncertainty. Therefore, herding can make investments riskier.

Herding is a natural tendency that arises in the financial markets when people act like a group. When the herd follows a certain investment strategy, it increases its prices. However, in a non-market environment, herding is not a problem. It can lead to poor decisions if investors are too afraid to take risks. There are many reasons why a herd is a good thing.

The herd psychology effect is a natural behavior that is observed in society. It is an expression of the herd instinct and is seen in many aspects of our society. For example, it is found in the financial industry, where investors tend to follow similar investment strategies. It can also create asset bubbles and market crashes. As a result, herding is a powerful force in the financial market. So, if you are an investor, you'll want to make a strategy that is in line with your personal preferences.

Large investors have shown to be less susceptible to herding than small investors, which has contributed to financial crises. In addition to the herding effect, research has also found that large investors tend to use diverse sources of information to make their investment decisions. This has a positive impact on the price of stocks and shares, but it also causes problems in the market. So, you need to take action to prevent the herding effect from taking over your investment.

Herding has significant implications for the stock market. Its existence has been linked to crashes, as it's common to follow your peers in a herd. Furthermore, it has a negative effect on the investment decision. It can result in a market crash, which can be shocking news for your investments. The authors of the study recommend a few simple changes to make the market more efficient. They will also make the raw data supporting their conclusions freely available.

A new study has revealed that herd psychology can influence an investor's decision to invest in certain stocks. This effect is caused by a fear of missing something or following the advice of others. As a result, investors often imitate others in their decisions. However, the herd behavior may not be a dreadful thing. Moreover, it can also be beneficial. Here are two ways to understand herd behavior and how it can impact your investment decision.

Herding occurs when an investor follows the crowd and makes a bad investment decision. When people start to pile into a stock, they may not do their due diligence or do not know much about it. This can result in a market crash. In addition, following the herd can lead to irrational exuberance, which can cause inflated asset prices. Another risk of following the herd is that people may not be aware of all the risks involved with a particular investment.

The herd psychology effect on investment decisions is a problem that has been ignored in the research literature. It can affect a person's investment decision if they lack confidence in their beliefs. In addition, investors may not have enough information about a stock, so they tend to follow the herd's lead. In these circumstances, herding can have devastating consequences for an investor's portfolio. Therefore, it is so important to understand how herd psychology affects the investment decisions of people in stock markets.

The herding behavior is a result of a lack of information. It is caused by a lack of confidence among investors. Other reasons include the desire to preserve reputations. This herding behavior can negatively affect the financial stability of a country. Consequently, it may result in market crashes and other forms of instability. For this reason, it is important to educate yourself on the behavioral biases that influence investor behavior.

The herd psychology effect can affect a person's investment decision. It can also have a negative impact on investments, which can affect the performance of the individual. The herd instinct is also responsible for mob behavior, conspiracy theories, and mass delusions. The best way to avoid this is to base your investment decisions on objective criteria. In general, people tend to follow the herd's lead - resulting in an increase in the price of a stock.

The herding psychology effect is a phenomenon that occurs when an investor follows the herd of investors. When a person imitates other people, they will invest too. When herding occurs, an individual's actions will follow the same pattern. This is the result of a herding effect. Herding behavior is also a result of peer pressure, which can lead to collective behavior.

Herding behavior in the financial market has been studied extensively in many fields, including biology and psychology. Herding tends to cause inefficiencies in the market, as people follow the herd of investors to maximize returns. Herding can also be caused by a lack of information. By following the herd, a person can make poor investment decisions. The result is an inefficient market. An investor should consider this effect before investing.

In addition to over-speculation, herding can also cause investors to make investment decisions that are not based on sound reasoning. Investing in a stock is highly dependent on the opinions of others, which is why they tend to follow the herd when deciding. Herding can lead to an investment failure. If you don't follow the herd, you might end up being a victim of the same effect.

The herding behavior of investors is like that of stampedes in animals. Herds are motivated by their peers' decisions, so they copy the herd and ignore their own. This type of behavior can lead to irrational decisions that may not benefit them. For example, managers may make investment decisions based on the opinions of other managers, disregarding substantive confidential information. Furthermore, they may feel that herding is a sign of a better company.

The herd psychology effect on investment decision making has been extensively studied in zoology and psychology, but it's also a powerful force at play in the stock market. We often follow the crowd and ignore the confidential information that can make or break our investment decisions. But is herd psychology really a problem? Let's look at the evidence. First, let's look at why people follow the herd.

We all tend to follow the herd when it comes to investing, but it's especially important to question why we do so. This may be a myth, but a study conducted by Borgers et al. (2015) has found that people often try to follow the herd, regardless of how wrong they think their investment decision is. And it doesn't necessarily mean that it's a promising idea. In fact, it might be worse for your investment decision if you follow the herd.

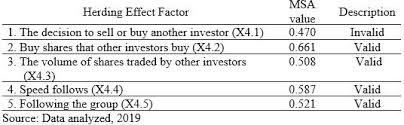

According to Armansyah (2018), the herding behavior affects investment decisions. It happens when investors follow the majority. Often, it's because they don't have the knowledge or information processing skills necessary to make a rational decision on their own. Therefore, if you want to invest in a particular stock, it's better to follow the herd. Herding behavior can lead to irrational decisions and faulty investments.

Studies on herd psychology show that investors use heuristics to influence their investment decisions. The BVPS also shows that herding affects the smoothness and stability of the capital market. But what about the herd? There's a difference. The heuristic theory suggests that herding is a promising idea if it is a positive influence, but it shouldn't be used in place of rationality.

Herd psychology affects investment decisions. When investors feel confident in a particular stock, they are more likely to buy it. But herds are not always efficient. It can create momentum by allowing novice traders to make a profit by buying and selling along with the crowd. But it's still a significant factor that influences investment decisions. While herding can be irrational, it's beneficial in some cases. It's a way to help novice investors make investments.

Herding is a common phenomenon in financial markets. The tendency of investors to mimic the behavior of others is called herding. However, this phenomenon can affect both investment returns and the efficiency of financial markets. In some cases, herding can result in market inefficiencies. For example, shading has been shown to negatively impact on investor returns. It's common for novice investors to follow the herd when it decides based on their own research.

Although the existence of information and its availability in the market is a key factor in investment decisions, the presence of it can affect how investors make their decisions. Ample information about the company can influence investors' cognitive attributes, but there's no evidence that it influences investment behavior. The data gathered by these two researchers reveals that the herding behavior of investors is a common psychological phenomenon in society. It can be detrimental to a company's reputation.

In a study of investor behavior in emerging markets, herding occurred when investors were following the herd. This behavior often led to panic-selling, which led to a crash in the market. In other cases, herding has caused investment trends to amplify beyond their fundamentals, creating unstable asset bubbles. So, while herd psychology does not affect investments, it is a major factor affecting financial markets.

The herd psychology effect on investment decisions has many practical implications. In the financial world, it can lead to market instability, resulting in billions of dollars of lost investments. In other areas of life, it can even lead to irrational behavior. In this case, the herding is the result of lack of knowledge. In addition to its negative impact on investment decisions, it can also cause financial inefficiencies.

Behavioral finance theories suggest that social influence is a major factor affecting investor behavior. Herd psychology is a result of over- and under-reactions in the market. While the stock market has shown an increase in the recent years, the herd has not impacted the market in the past. Instead, the herd has been reinforced by the volatility. It has also influenced the decisions of investors. As a result, the herd has distorted information.

The Benefits and Risks of Investing in Cryptocurrency

The cryptocurrency is a form of digital currency, which is not directly tied to a government or country. Rather, it is designed to function as a medium of exchange. It has many benefits and is used widely. Let's have a look at its benefits. The primary benefit of cryptocurrency is that it is a safe way to exchange funds. However, it is not without problems. If you're wondering what cryptocurrency is, then read on.

While there are some risks associated with investing in cryptocurrency, it's becoming increasingly popular. It is important to remember that the value of cryptocurrencies is still in their infancy, and there are no guarantees. As with any new investment, you should invest conservatively. There are no guarantees, and your investments are at risk. Even if you are a professional investor, it's best to seek financial advice from a licensed financial advisor.

While there are many benefits, cryptocurrency is also a high-risk investment. There are no government regulations for cryptocurrency, and the value is still based on speculation. If you lose your password, you may not be able to access your account. The value of cryptocurrency is highly volatile and difficult to recover. The CFPB has published a report warning investor of the risks of investing in this technology. Nevertheless, cryptocurrency can be a useful addition to a diversified portfolio.

A recent article in the Wall Street Journal discusses the benefits and drawbacks of cryptocurrency. The main benefit of cryptocurrency is that it is anonymous and non-intrusive, so there's no need to reveal your personal information. In addition, it can also be used as a tool to fight corrupt governments. The legality of cryptocurrencies varies in different countries, but they're legal in the U.S. and the United Kingdom. In the United States, it is legal to trade in cryptocurrencies, but China has tried banning them.

A crypto-based asset is a digital form of an asset that is backed by a physical asset. Its supply is limited and is usually referred to as a "cold wallet". A cold wallet is one that is not actively connected to the internet and will not allow you to spend your funds. In contrast, a warm wallet is one that uses physical media, but will never be active on the Internet. A hot wallet can sit in the cloud, but it won't be accessible online.

The cryptocurrency market has a variety of uses. Tokens can represent video snippets, music albums, and even artwork. Some experts say the technology is a bubble, while others believe it will change investing forever. But overall, cryptocurrency will be used to make purchases, which is why it's so widely available. This will help the people who are involved in the crypto markets to avoid the pitfalls and make their investments in a secure way.

The cryptocurrency has many uses. Its anonymity and decentralized nature make it perfect for a variety of transactions. Because it doesn't rely on any central authority, it is a fantastic way to fight corruption. It's fast, cheap, and untraceable. But a few things to keep in mind about cryptocurrencies: they're incredibly difficult to counterfeit. While the cryptocurrency is remarkably like cash, it is different from a traditional bank. It's different from a currency, and you can't use them everywhere.

Some of the most popular cryptocurrencies are Bitcoin, Ethereum, Litecoin, and Cardano. But while these currencies have many uses, they're not a desirable choice for every investor. It's better to invest a small portion of your portfolio in one or two companies. But if you're worried about the future of the cryptocurrency market, don't be afraid to experiment with diverse types of cryptocurrencies.

One of the biggest advantages of cryptocurrency is that it's decentralized, meaning that users maintain and control it themselves. As a result, it can be used as a medium of exchange for a wide range of transactions. Unlike traditional currencies, cryptocurrencies are backed by a central bank. Despite their popularity, they're still not fully regulated. The U.S. dollar is backed by the full faith and credit of the U.S. government.

What is a Commodity?

A commodity is an economic good, which can be traded on the market. A commodity's full fungibility means that all its instances are equivalent. However, the term "commodity" is often used to refer to any resource, such as gold, silver, oil, or copper. A commodity is the basic building block of economics, which is why it is called a raw material. This article will explain more about the diverse types of commodities.

The most common types of commodities are natural gas, petroleum, agriculture, and agricultural products. These are essential to many industries, such as the food and drink industry. They are also traded on the commodity exchanges, which means that investors do not have to know the source of the commodity to make a purchase. Aside from gold and silver, many other types of commodities are traded on these exchanges. The Chicago Board of Trade is the largest exchange for the trading of agricultural products, while the Minneapolis Grain Exchange is the biggest for industrial metals.

The price of commodities is related to the price of the commodity. The dollar value of a commodity increases or decreases depending on economic factors. For example, gold, sugar, and silver are valuable commodities, but the price of these goods is highly volatile. It is important to remember that the commodities you buy and sell have risks, so do your research. When it comes to trading a commodity, you should talk to an experienced broker who is familiar with the product and the market.

Soft commodities are seasonal. Hard commodities are the most volatile. You may be able to find gold in your local grocery store. If you want to invest in an energy company, you can buy shares of the stock in the company. A hard commodity is a volatile commodity. So, diversifying your portfolio is a promising idea. A diversified portfolio will allow you to earn a good profit without investing a lot of money.

A commodity is a type of economic product, which is traded in a market. A commodity is a product that can be sold as a whole or in pieces. In a commodity super cycle, the price of commodities will rise and fall in relation to the price of other commodities. One example is gold. The gold prices will increase and fall in the future. The market will continue to trade in this form of currency until the commodity's price goes down and is worthless.

Agricultural commodities are the main sources of food and energy. Agricultural commodities, such as corn, are traded on the market as the main raw materials. They are interchangeable, which allows traders to sell and buy from anywhere in the world. If you want to buy cocoa, you can purchase it from any country. Alternatively, if you are interested in soybean oil, you can purchase it from Cameroon. If you are interested in buying cocoa, you can find it in Ghana.

Some commodities are more valuable than others. If you are interested in purchasing a commodity, you can find a good deal on it. For instance, some farmers sell their crops. If you are selling raw materials, you can sell it as a commodity. The price is higher when it is cheaper than if you are selling a raw material. In some markets, a substantial value is measured in kilos. Usually, a pound of a commodity is based on its weight.

As you can see, commodities are popular ways to diversify your portfolio. They can also be traded in shares. Although the market for these items is volatile, it is possible to trade them on the same exchange. A stock can be a great hedge against inflation. Its price fluctuates only in response to the price of the commodity. If you are investing in commodities, you should know that it is highly correlated with other assets. For instance, oil is highly correlated to gold, and a diamond is more expensive than oil.

While it is important to know that commodities are volatile, there are certain commodities that are more volatile. For instance, energy and livestock are both commodities. A farmer who grows sugarcane needs to plan. A farmer who sells sugarcane must have enough time to make the crop. He must also make sure that he is able to sell it quickly. Hedging can be a fantastic way to minimize the risk of a farm.

The Advantages and Disadvantages of Decentralized Finance and Economics

The premise of decentralized economics is that the government should not control the flow of money in the economy. The government should be a mere intermediary in the exchange of goods and services. This is the basis of the concept of decentralized economics. A country can have multiple currencies. A country can have only one currency. A decentralized system should not allow the circulation of different currencies within the same country. Nevertheless, the idea is an excellent one, as it allows for fair competition among nations.

The concept of decentralized economics is a powerful way to improve the economy and give remote regions access to money. It is also a revolutionary idea for the future of financial systems since it combines traditional banking and next-gen technology. As a result, it is possible to achieve better prices and quality. While there are many advantages of decentralization, there are also a few drawbacks. First, the idea of a decentralized economy is not necessarily better for everyone. In fact, some people believe that the opposite is true.

A decentralized economy may seem a strange concept. Yet, its benefits are many. It is a critique of the market-economy model. The concept of a decentralized economy has gained momentum in recent years, and experts say it can make the economy more efficient. It can also reduce costs. It has a lot to do with virtual currencies and financial decentralization. These two elements are connected and affect the economy.

It is an ideal system for decentralized finance. This kind of economy uses smart contracts to provide services that banks, and brokers used to provide. It doesn't require permission from anyone and can produce impressive returns. By removing the middleman, decentralization can make money for everyone. There is no limit to the amount of wealth this system can create. And because of its openness, it can be a great solution for many problems in the world.

The idea of decentralized economy has many advantages. For example, it can eliminate the need for governments. By eliminating central governments, people will have more control over their money. This way, people will be more likely to have access to the resources they need. Unlike with traditional financial institutions, a single central authority will not govern decentralized economies. Hence, they will be more efficient and sustainable. The only downside is that they will have to compete.

The principle of decentralization has been used in many areas for centuries. In the past, the East India Company ran factories in remote regions of the world, and the Morgan family run their bank in isolation from other countries. However, today, the concept of decentralization has been gaining traction, and the idea of a common governing body has become a reality in several countries. In addition to this, the modern technology that has accelerated the development of the economy can also be used in healthcare.

The decentralized economic system is based on decentralized planning and decision-making. It is opposed to a command economy, which is based on central planning. It is a system that is based on the principle of decentralization. In this sense, the emergence of technology is the premise of decentralized economics. The democratization of the economy has facilitated the growth of many countries. The idea of a decentralized economy is a positive phenomenon in society. The benefits of this change are not only global but also societal.

While the Internet Economy was hampered by the proliferation of high-speed connections, blockchain technology can open the door to an equitable global economy. In addition to the potential cost savings, decentralized economics also increases the rate of change. It is faster and cheaper to operate. As a result, it is a more effective way to invest. The technology already exists. For instance, Coinbase has thirteen million users. All these factors are beneficial for the economy.

The concept of decentralization has been studied extensively throughout history. The Austrian school economist Friedrich Hayek conceived of the market as a decentralized mechanism for coordination of needs. Similarly, the concept of distributed networks is also connected to the economics discipline. The Institute of Decentralized Economics will study how markets function in distributed systems. The goal of this initiative is to understand the economics of blockchain and make it practical. In particular, the concept of a stable coin is crucial for the success of an economy.